News

Featured Articles

Stop by AGA Central during DDW

See the 11 mentors voted best in our field

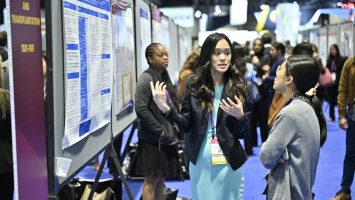

Discover inspiring research at DDW® 2024

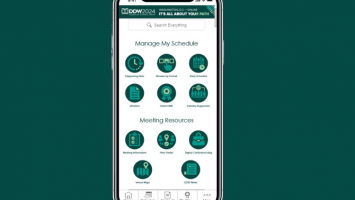

Just launched: DDW® 2024 Mobile App

Three weeks left to register for DDW®

Join AGA for international education opportunities at DDW® 2024

How to navigate mentorship

Review your reported provider data in Open Payments

The Shark Tank winner is Arithmedics!

AGA Pocket Guides

Official AGA Institute quick-reference tools provide healthcare providers and students with instant access to current guidelines and clinical care pathways in a clear, concise format. AGA Institute pocket guides are available in print and digital form.

Member Non-Member

AGA clinical guidance

Find the latest evidence-based recommendations for treating your patients.